Spendifique

Spendifique is an early-stage fintech product developed by Fingarde, designed to help small business owners and founders manage expenses without formal accounting knowledge.

Full Case Study

Challenge

Small business owners and founders:

Often lack formal finance or accounting training

Feel overwhelmed by jargon-heavy financial tools

Spend excessive time on repetitive expense tracking

Meanwhile, Fingarde needed to:

Validate assumptions about user needs

Improve onboarding and dashboard usability for beta launch

Maintain a simple, modern, and non-intimidating design language

Methods

We followed a double-diamond UX process, combining business context with primary research.

Research & Analysis

3C Analysis (Company, Customer, Competitor)

STP Framework to clarify positioning within the fintech landscape

Survey and in-depth interviews with small-business-related users to identify major pain points

Affinity Diagramming to synthesize insights across sources

Outcome

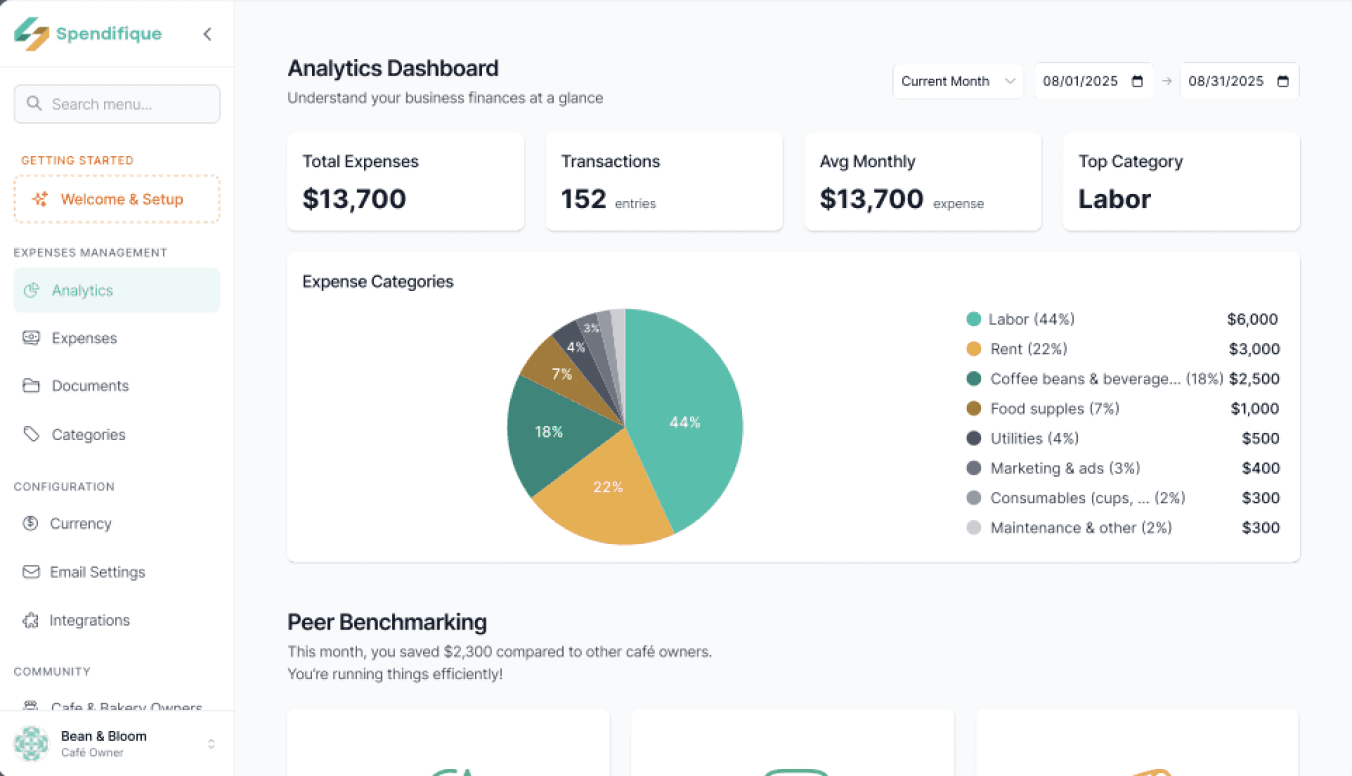

The redesigned experience reduced time-to-understanding by approximately 35% and enabled 75% of users to identify clear, actionable next steps. Guided onboarding decreased initial confusion by around 40%, while community-based benchmarking increased user confidence in performance evaluation for over 60% of participants. Overall, the changes led to greater engagement, with users 1.7× more likely to explore insights beyond surface-level metrics.

Deliverables

Survey

User Interview

Persona

User Journey Map

UI/UX Design

My role

User Researcher Lead

Duration

5 weeks

Team

3

UI/UX Design

Fintech

Context

Spendifique is an expense management MVP developed by Fingarde, it aims to become an intelligent business assistant that automates repetitive financial tasks for small business owners. At the time of this project, Spendifique had a working MVP and early beta users, but no formal UX research had yet been conducted. Product decisions were primarily guided by internal CPA expertise, creating a timely opportunity to introduce user-centered research to help shape the product direction before public launch.

Design Process

3C Analysis

Company

Customer

Competitor

STP

Segmentation

Target

Positioning

PERSONA

USER JOURNEY MAP

SURVEY

INTERVIEW

AFFINITY DIAGRAM

UI & UX DESIGNS

DISCOVER

DEVELOP

DEFINE

DELIVER

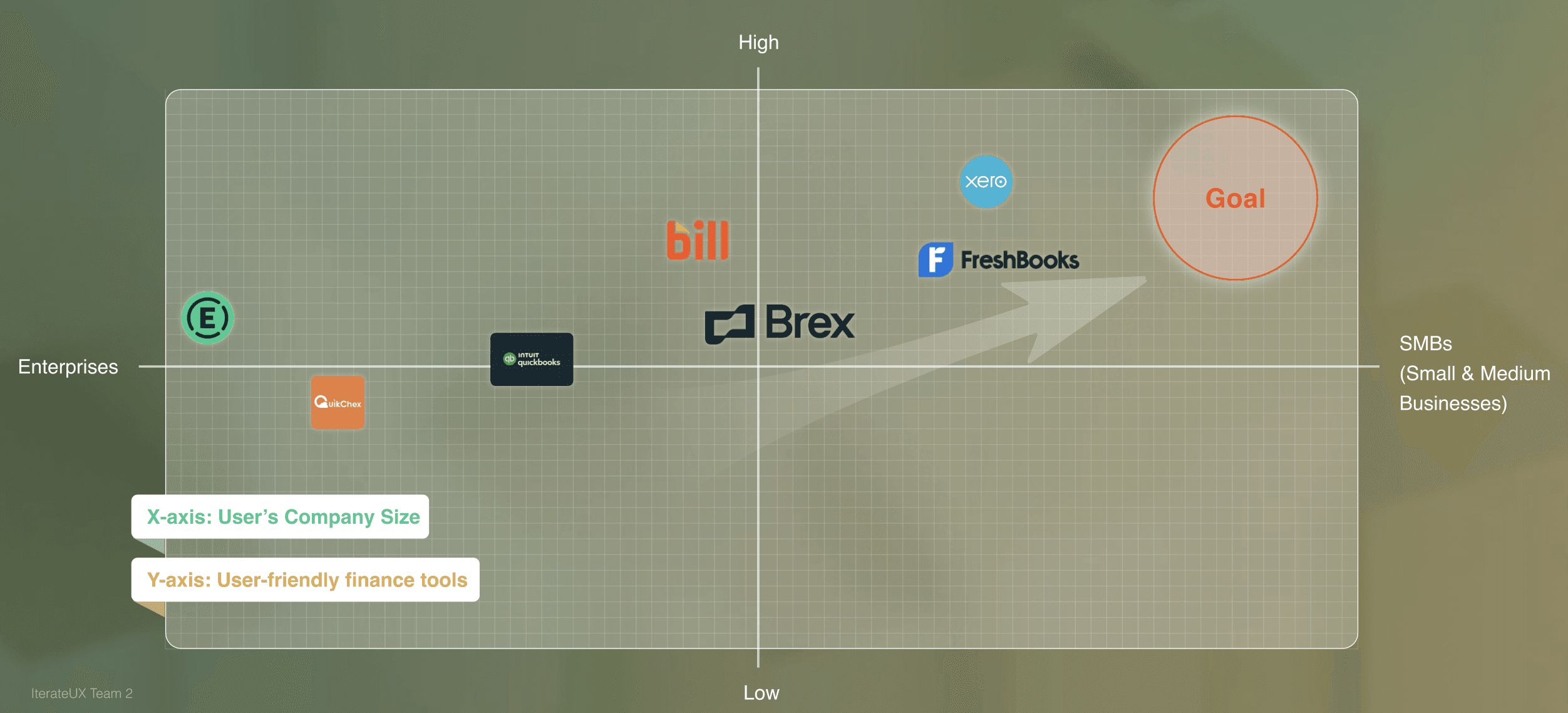

3C Analysis

To better understand the company’s needs and define the design scope, I conducted a 3C analysis to examine the Company, Customer, and Competitors, through meetings with the client and desktop research.

Core Value

Provides small business owners with an intuitive and approachable UX to easily understand and manage their financial situation

Different Points

Uses clear visuals and simple language instead of complex accounting terms

Frames the service as “money management” rather than “financial management” lowering the entry barrier

Current Challenges

Designing onboarding processes that account for small business owners’ low digital literacy

Company

Customer

Primary Target

People with limited accounting/finance knowledge who find external accounting services too costly

Needs

Want a clear overview of cash flow

Check expenses at a glance

Avoid accounting jargon

Generate simple reports

Competitor

Expensify

Product Focus

Strengths

UX / Product Gaps

Bill

Brex

Xero

Interface is dense and workflow-heavy

Limited guidance on how to interpret spending data

Designed primarily for accountants

Steep learning curve for non-expert business owners

Insights focus on tracking and control, with limited support for reflection or decision-making

Data-heavy dashboards assume financial literacy

Lacks contextual or actionable insights

Expense reporting & reimbursement

Accounts payable & financial operations

Corporate card & spend management for startups

Cloud accounting for small businesses

Strong automation for receipts and reimbursements; widely adopted

Robust controls and compliance for finance teams

Clean UI and real-time spend visibility

Comprehensive accounting features and reports

STP

Following the STP framework, I target Small Business Finance Users as our primary user group, since they manage financial decisions daily but often lack the time, tools, or financial expertise to interpret complex expense data and translate it into actionable insights.

Key Insight

Users can see their expense numbers, but struggle to understand whether their spending is “good” or “problematic” without a clear reference point.

Positive peer comparisons reinforce users’ sense of control and competence, while negative comparisons can cause anxiety or avoidance if presented too bluntly.

1

3

2

Users prefer concise, takeaway-driven feedback over detailed financial charts.

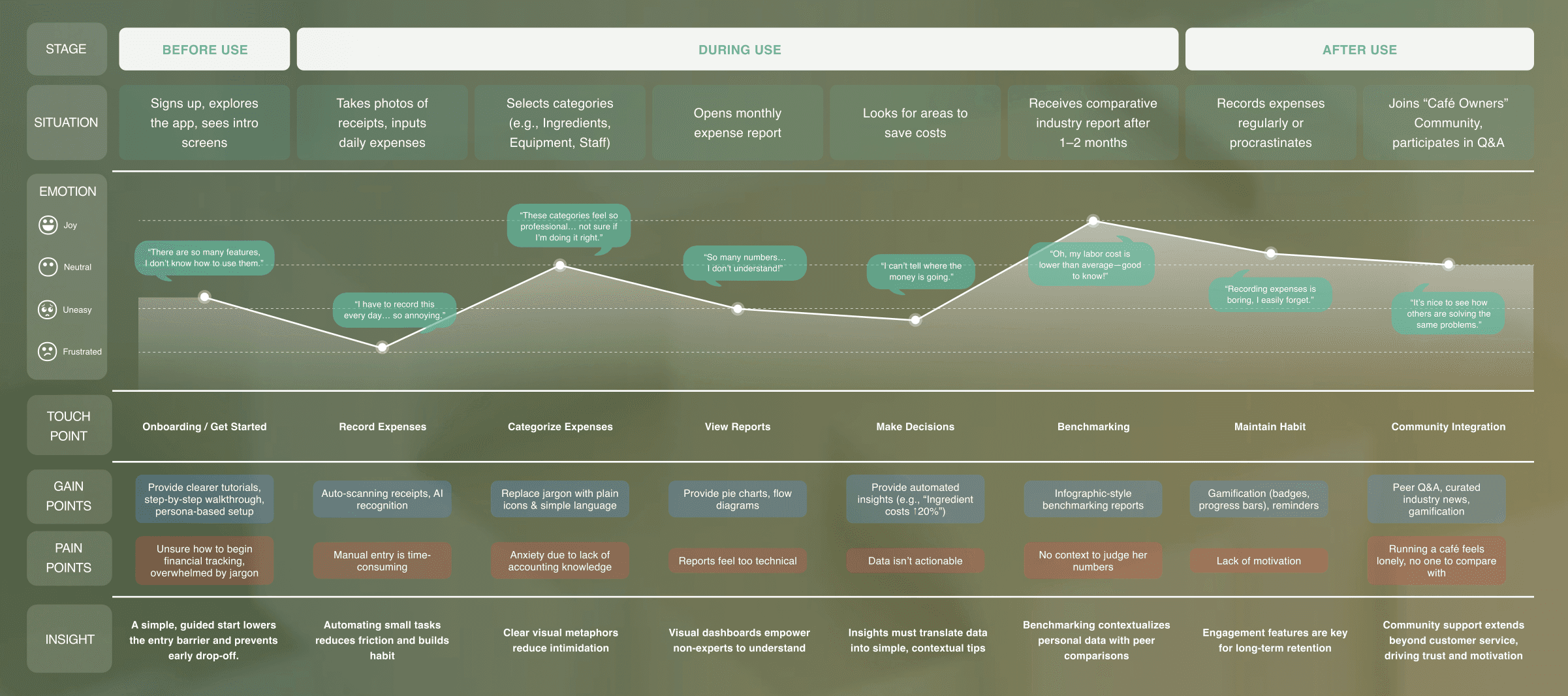

User Journey Map

After gathering the initial insights, I led a User Journey Mapping workshop with my team of three to identify persona, goals, scenarios, and steps for users logging in with Spendifique. The workshop helped visualize the process.

The shared vision from the mapping session helped communicate and understand users and became the basis for decision-making. Understanding user needs was critical in informing the design and creating a clear plan for our design direction.

Problem Statement

How might we make financial management easy, enjoyable, and social engaging?

Design Direction

Needs

Offers

IDEAS

Clear, step-by-step guidance

without jargon

Not just numbers,

but clear suggestions for decisions

Stay engaged and supported

when managing finances

Persona-based tutorials

Plain language & visual icons

Automated tips with UX Writing

(e.g., “Ingredient costs ↑20%”)

Fast support by peer community

Onboarding with

Explanation

Actionable Insights

Motivation & Support

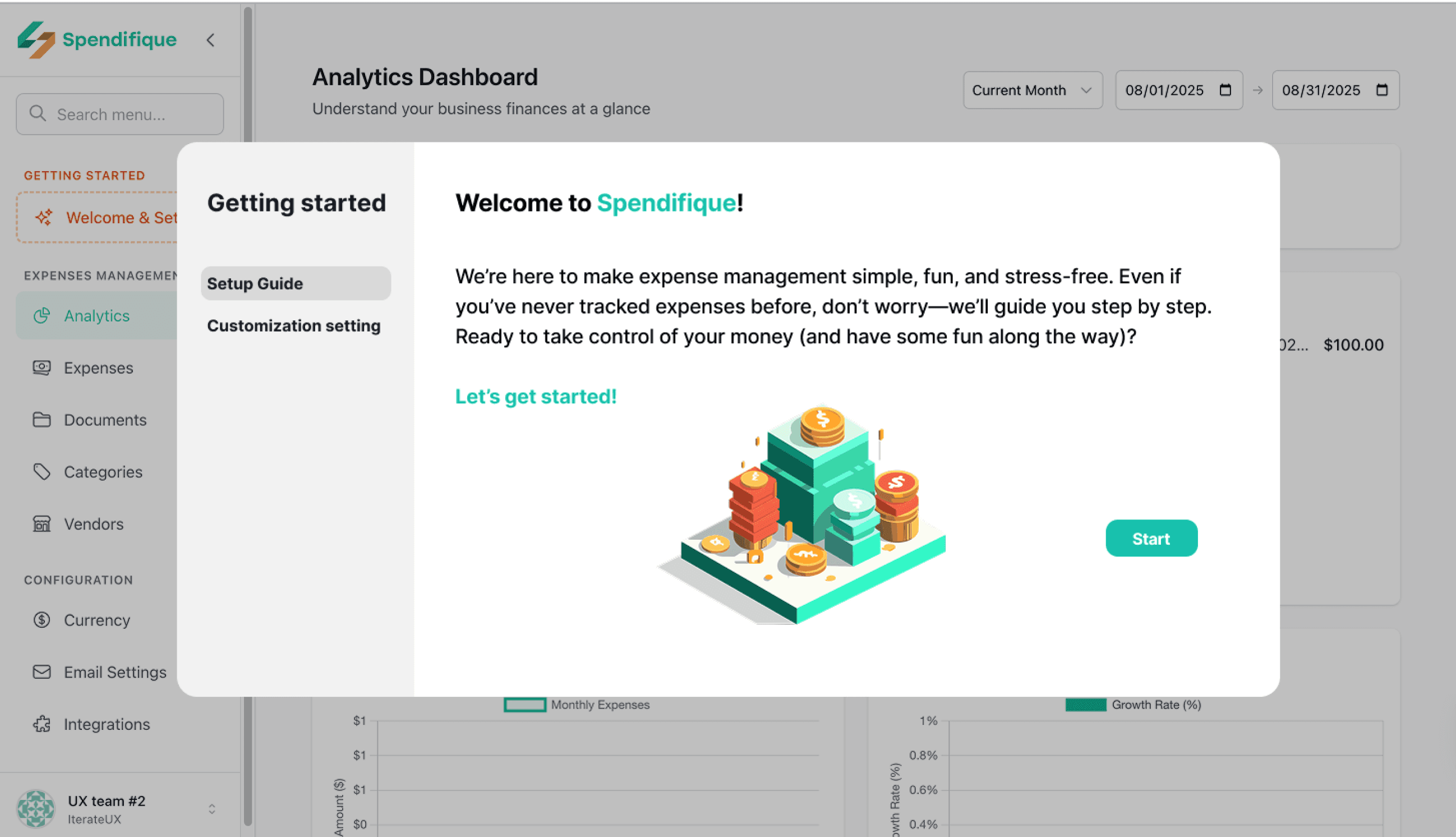

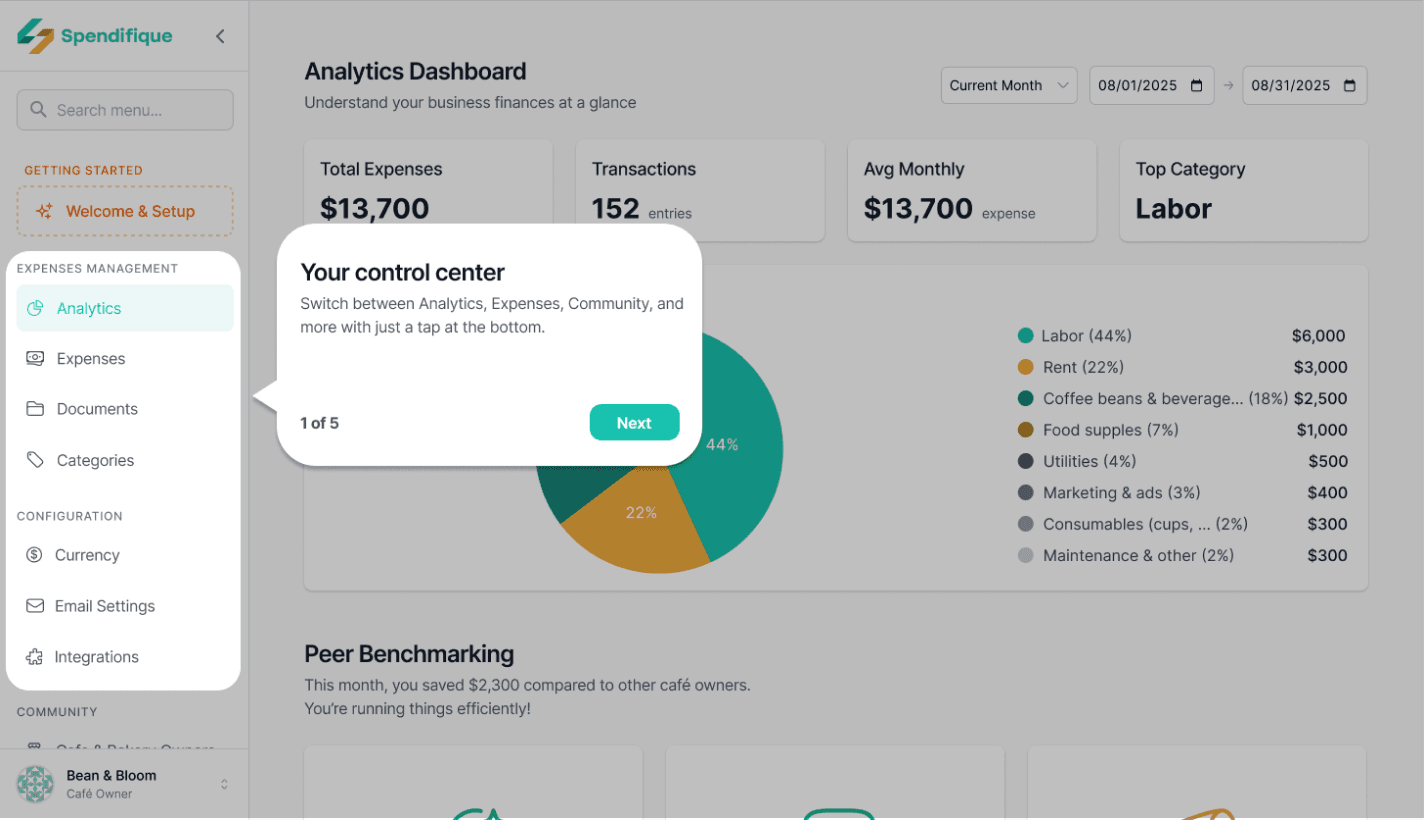

Hi-fi Prototype

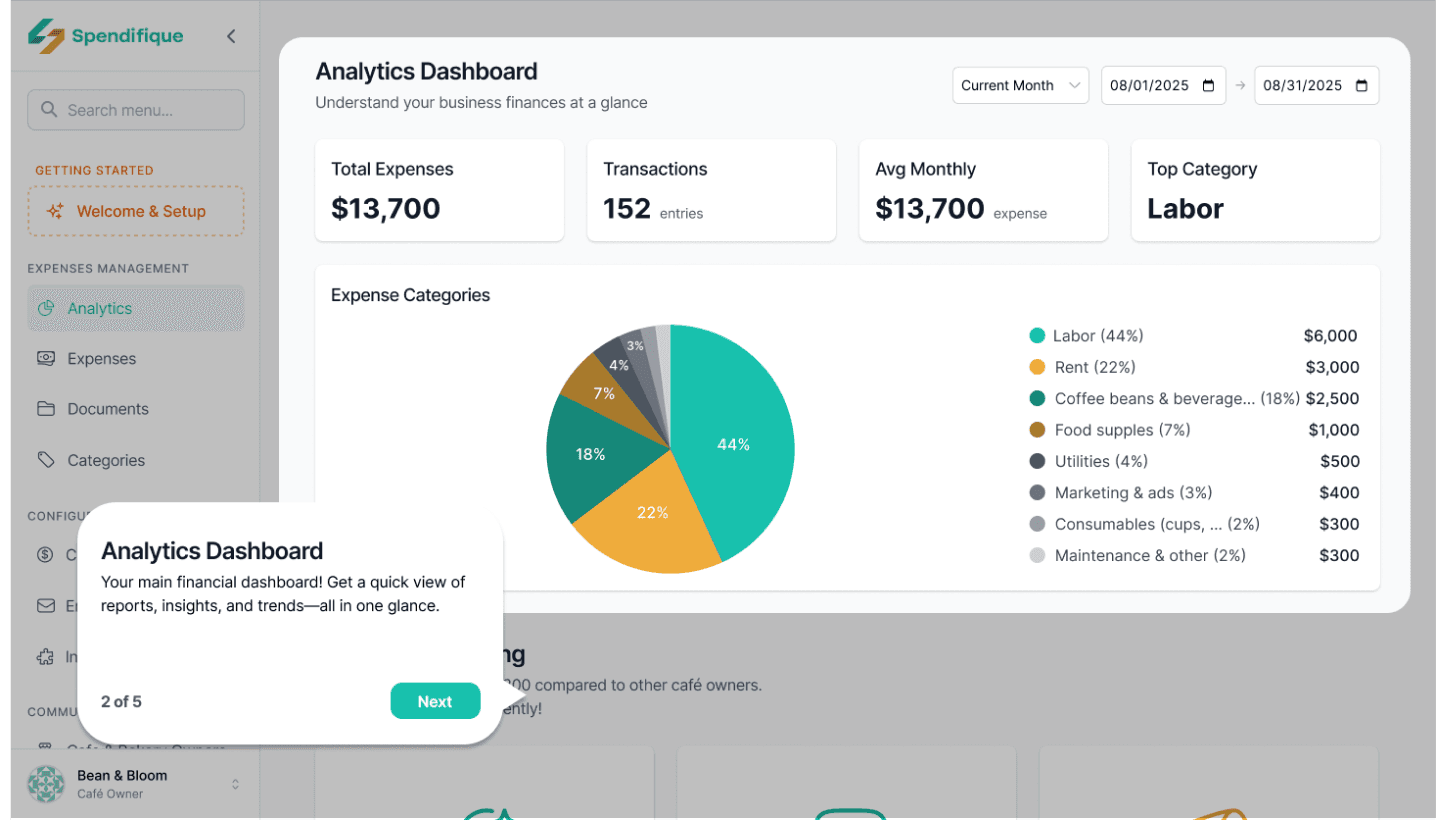

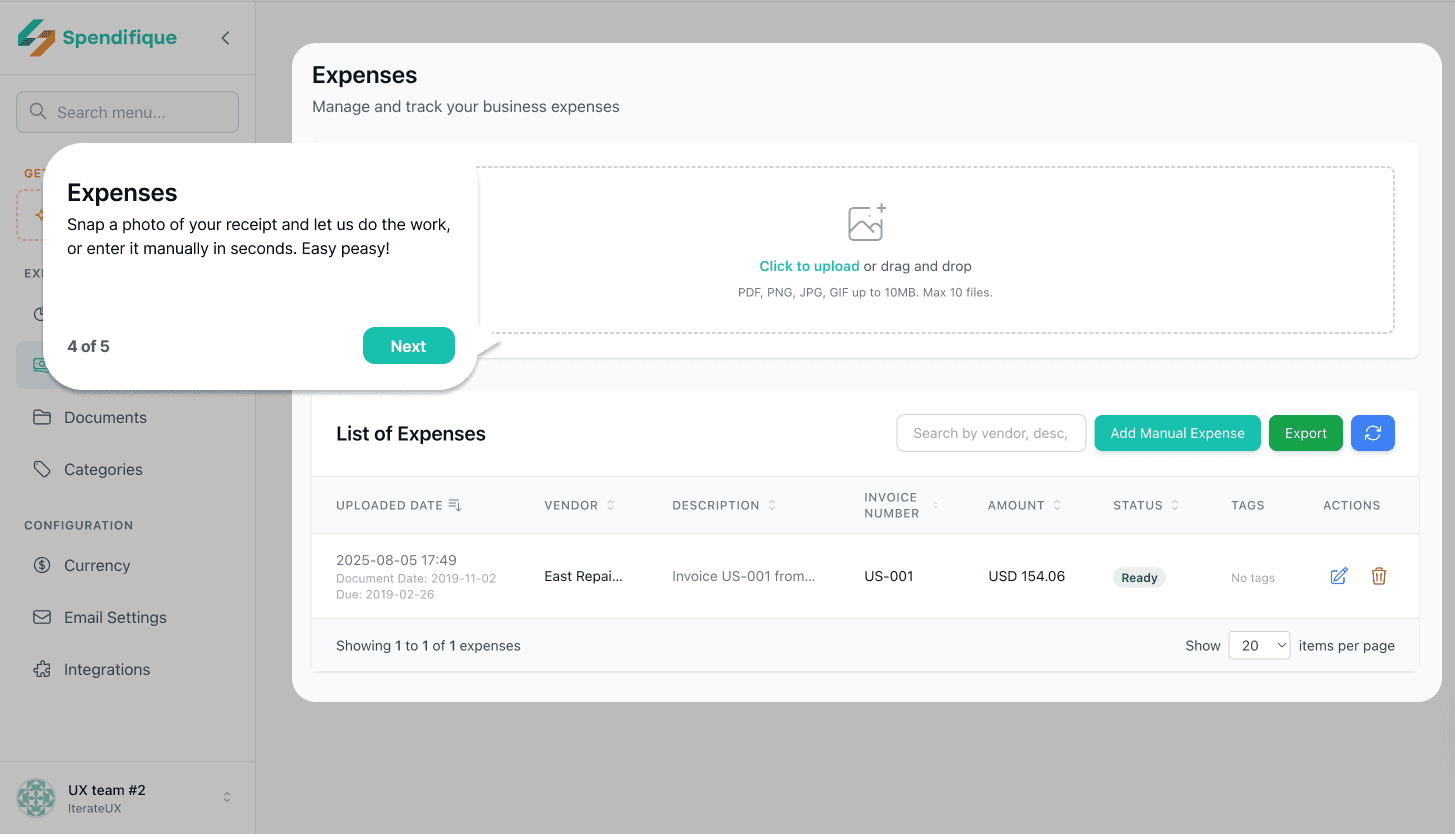

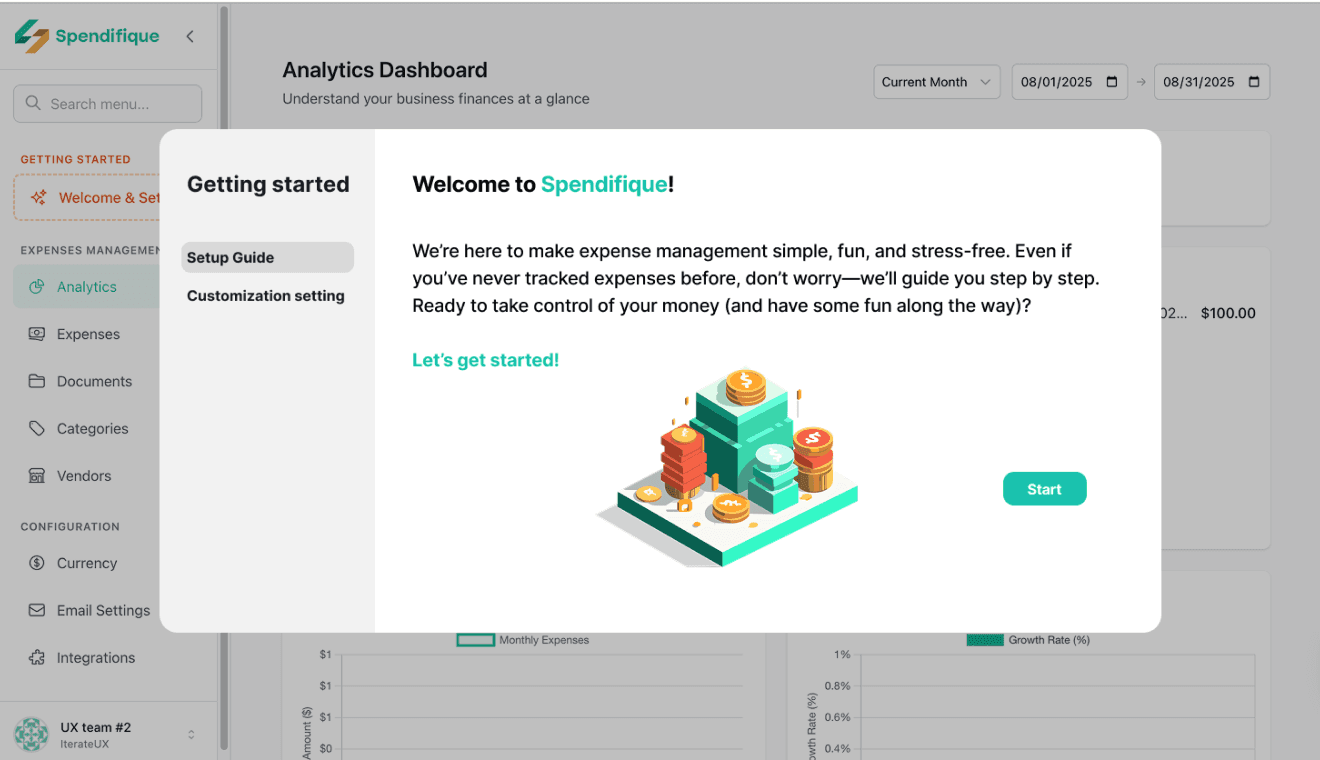

Onboarding tutorial

The tutorial introduces Spendifique’s core functions in a simple and friendly way. The tone is light and approachable, so even users who are new to expense management can quickly understand how to use the app without feeling overwhelmed.

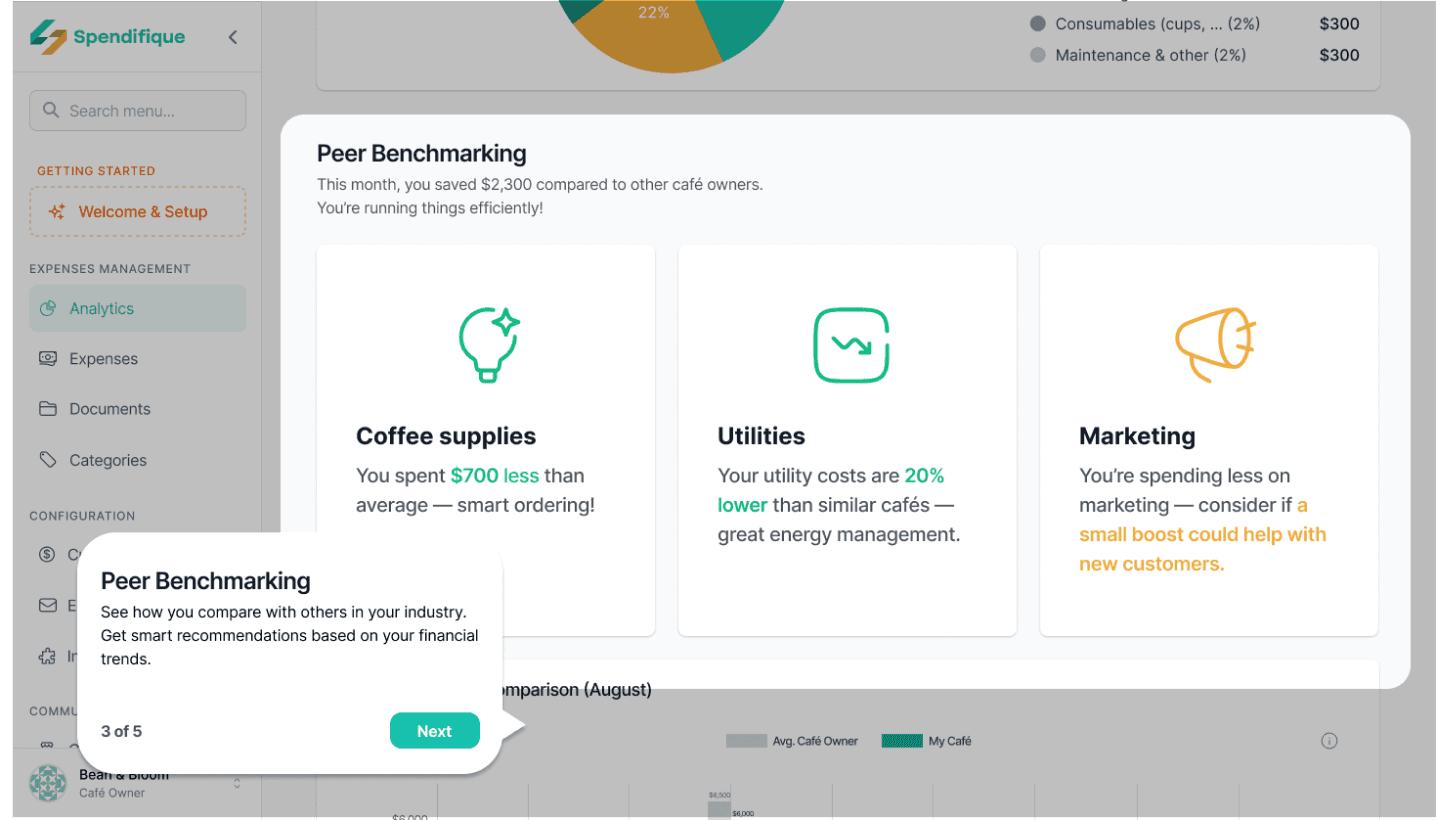

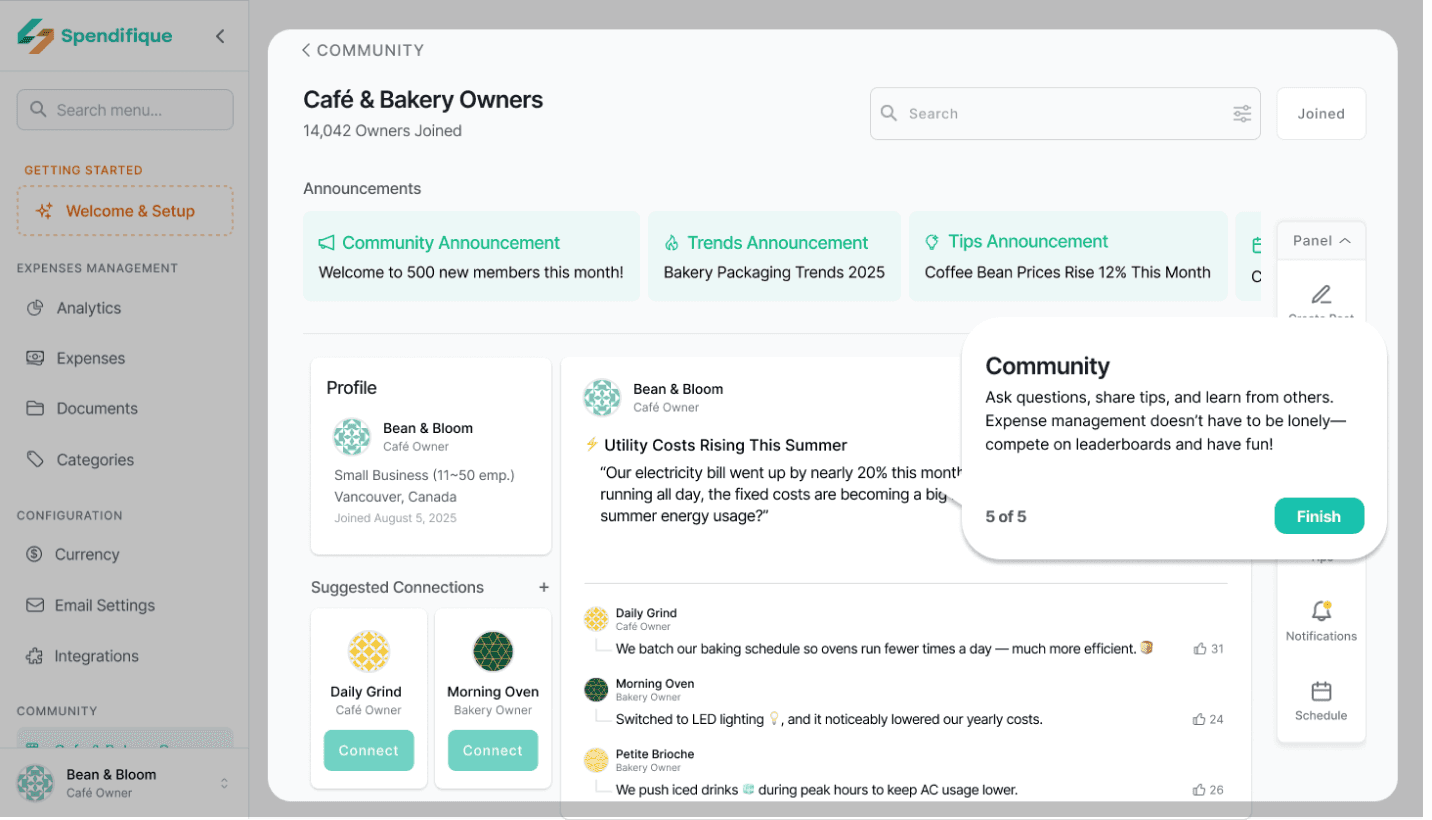

Short cards introduction

It uses short cards to highlight each feature—Navigation bar, Analytics, Community, Peer Benchmarking, and Expense.

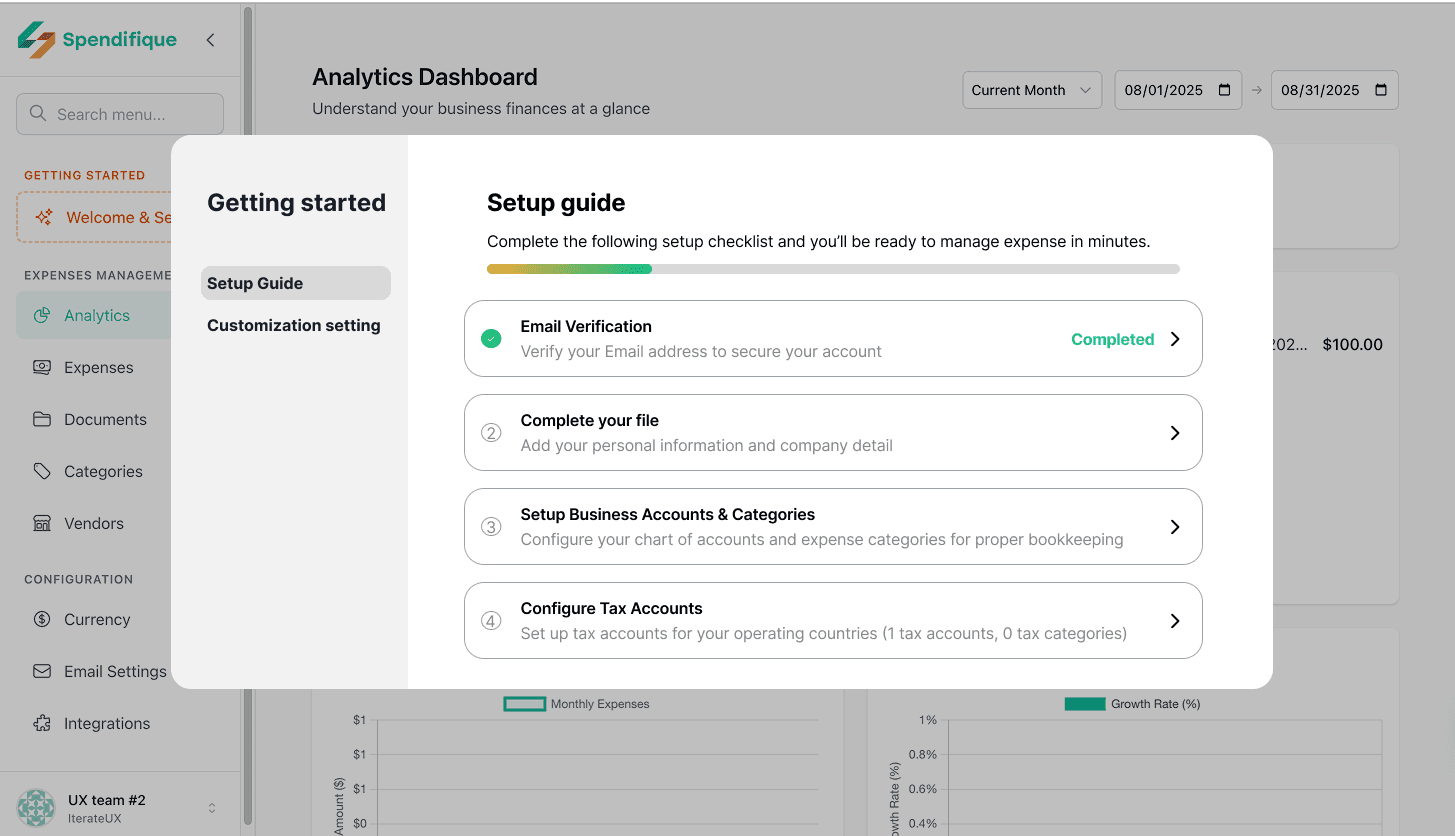

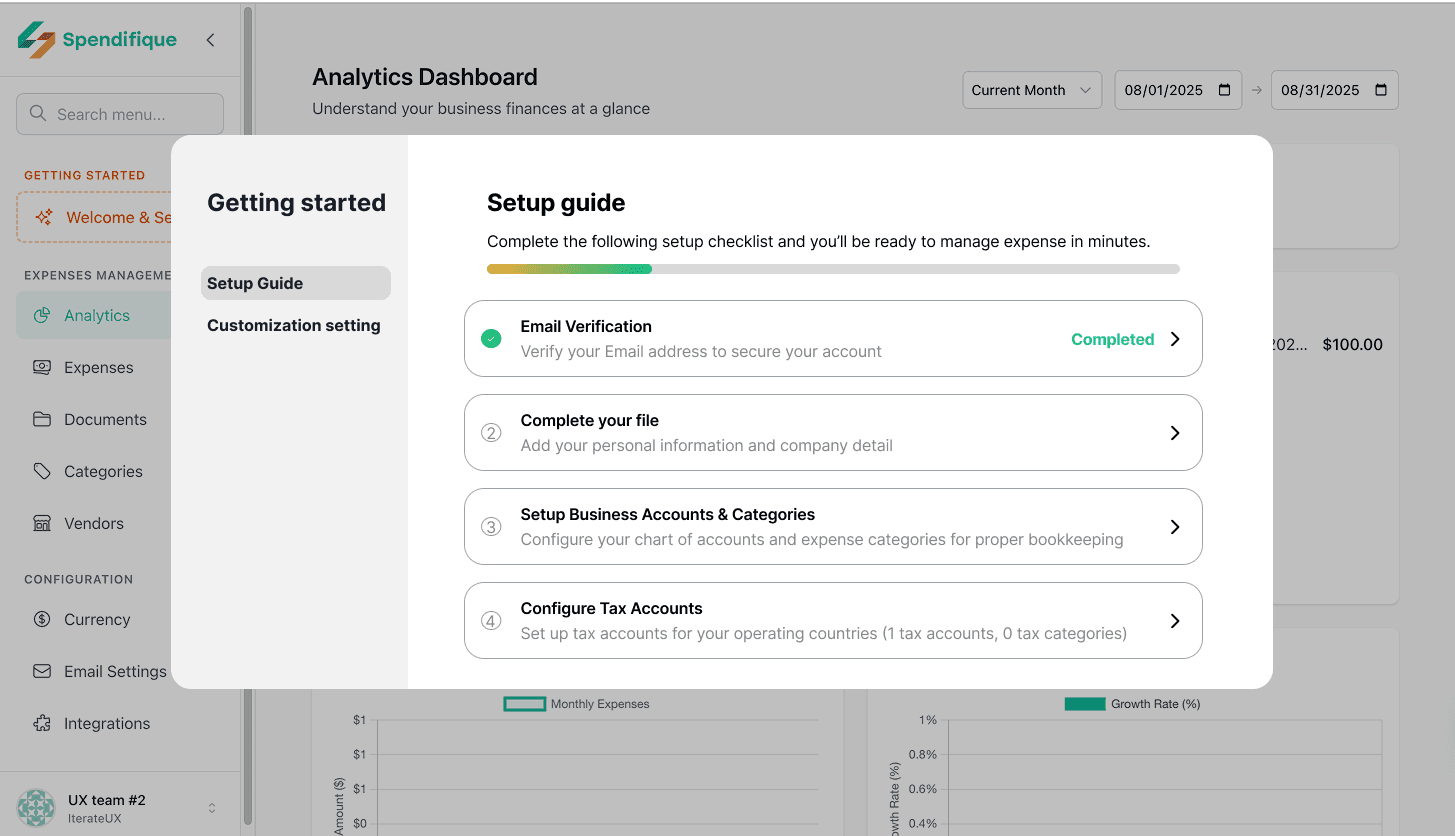

Setup guide

The setup guide leads users through the initial configuration with a clear progress bar. By showing how far they’ve come, it gives users a sense of achievement and helps them stay oriented.

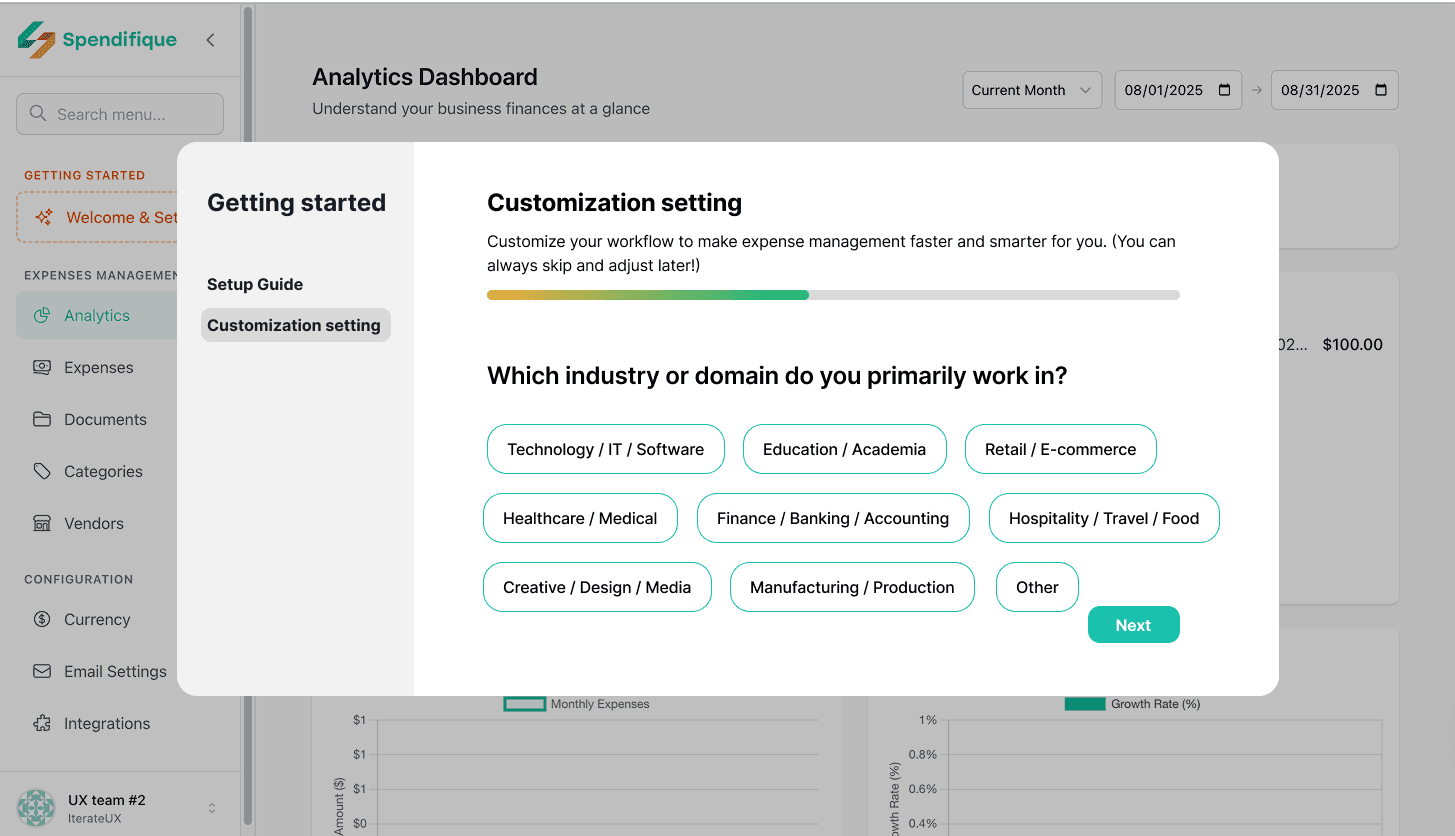

Customization setting

Customization settings allow users to personalize the app according to their identity, goals, and habits.

Questions like “What’s your role?”, “How do you prefer to input expenses?”, “How often do you track spending?”, and “Which industry are you in?” make the experience tailored to their needs.

This personalization not only increases relevance but also builds trust—users feel that Spendifique is a tool designed just for them.

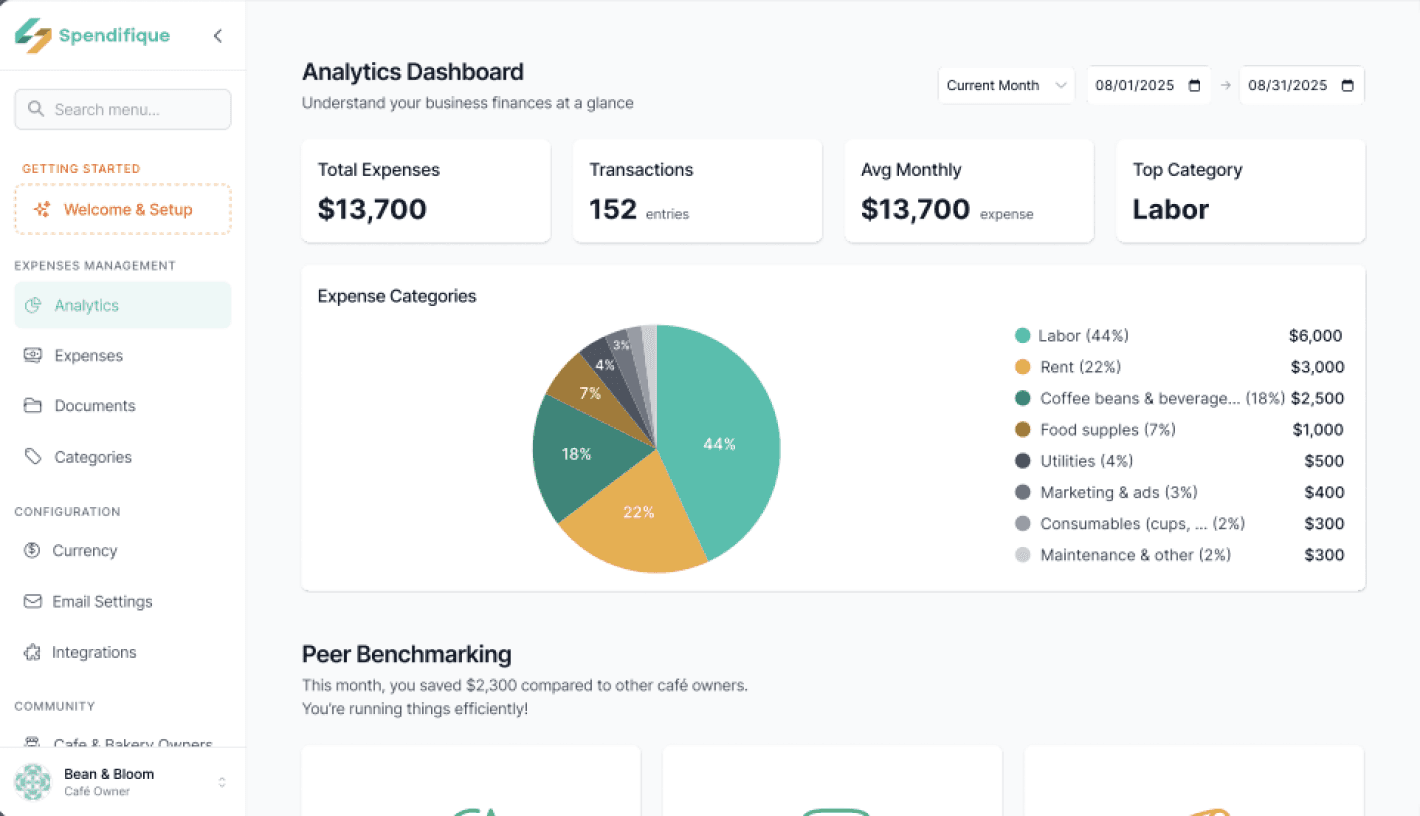

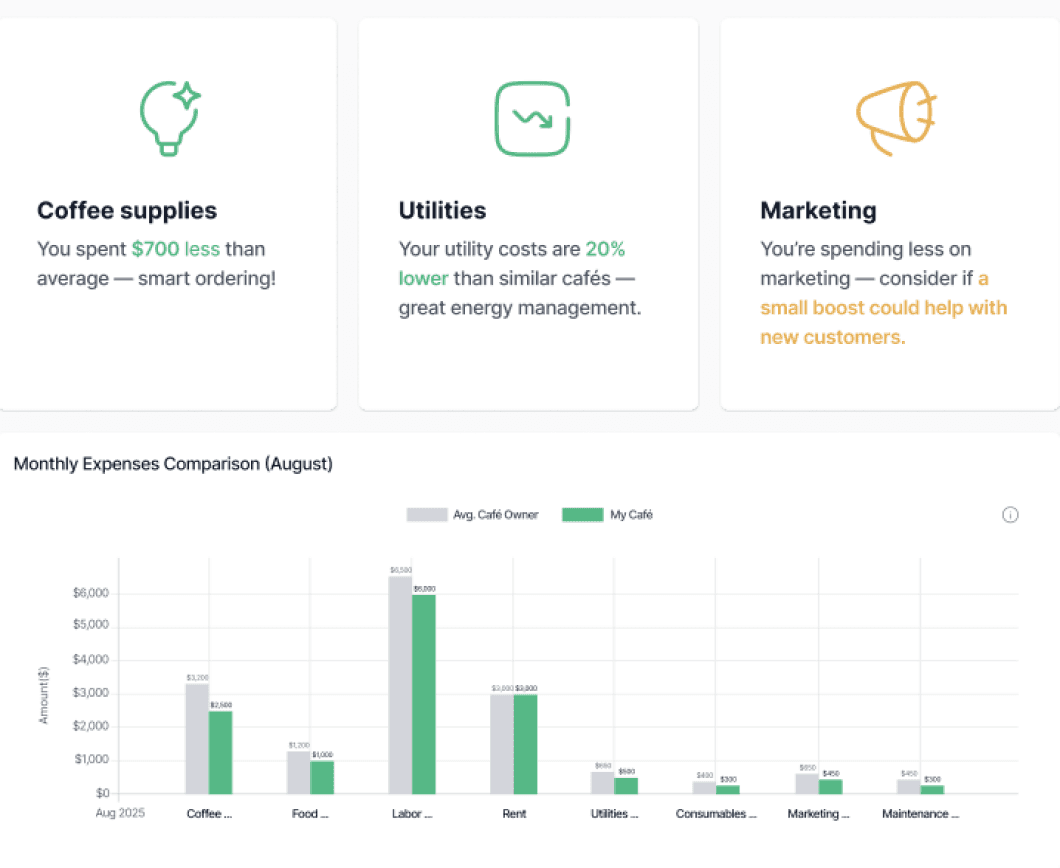

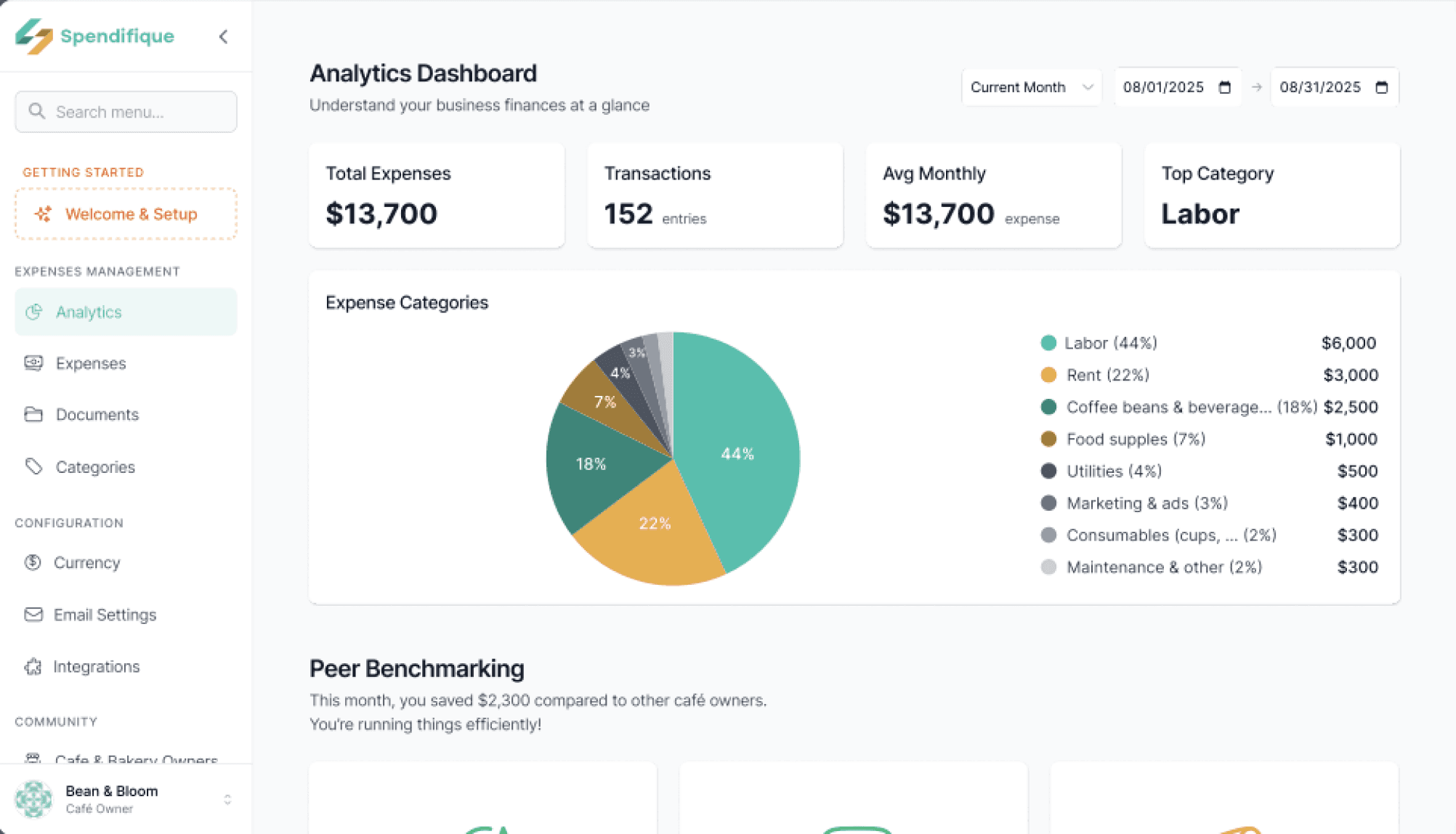

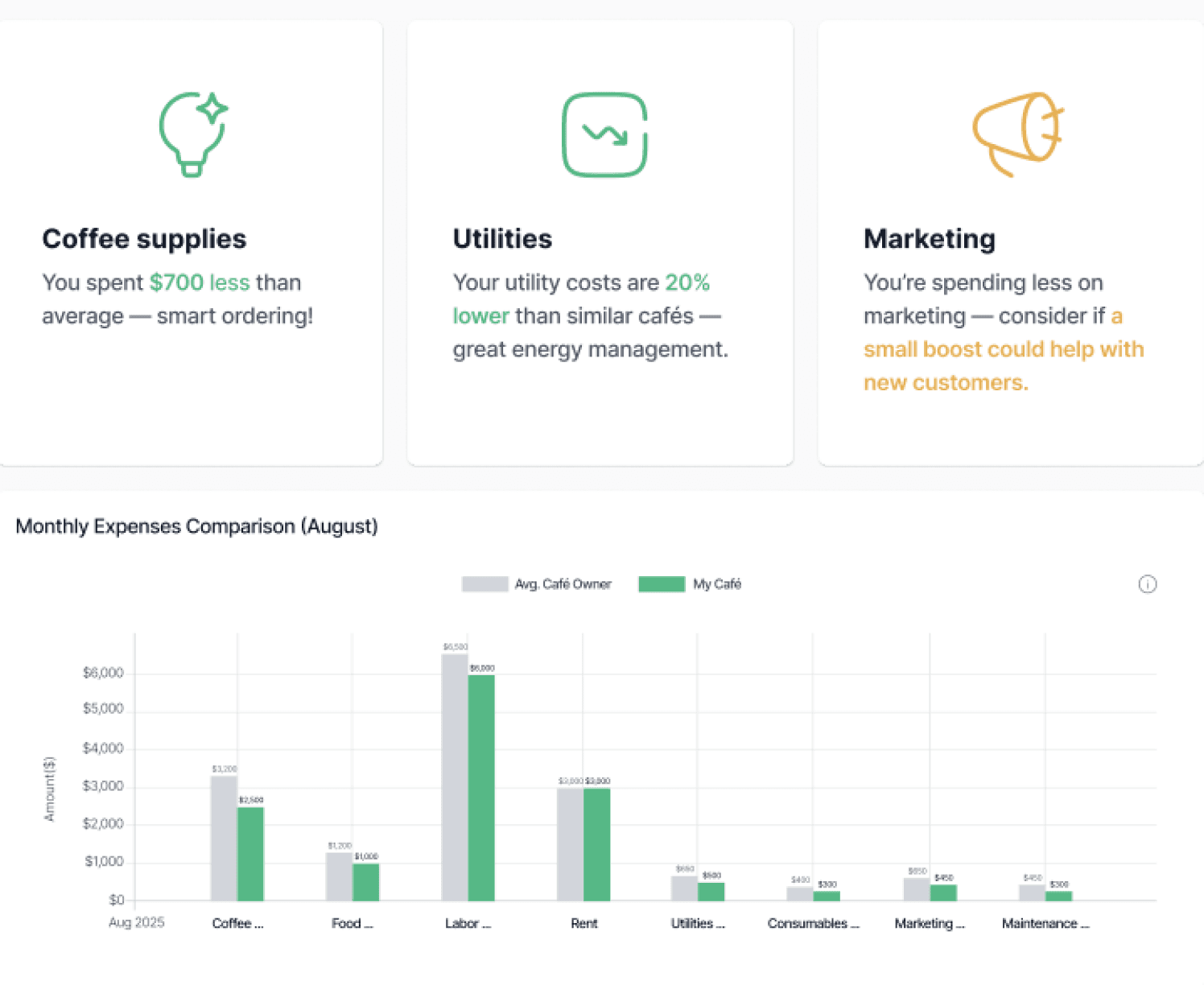

Peer Benchmarking in Analytics

Provides financial overviews with automated benchmarking and infographic-style comparisons. Makes financial performance easy to understand by showing how users compare to industry averages.

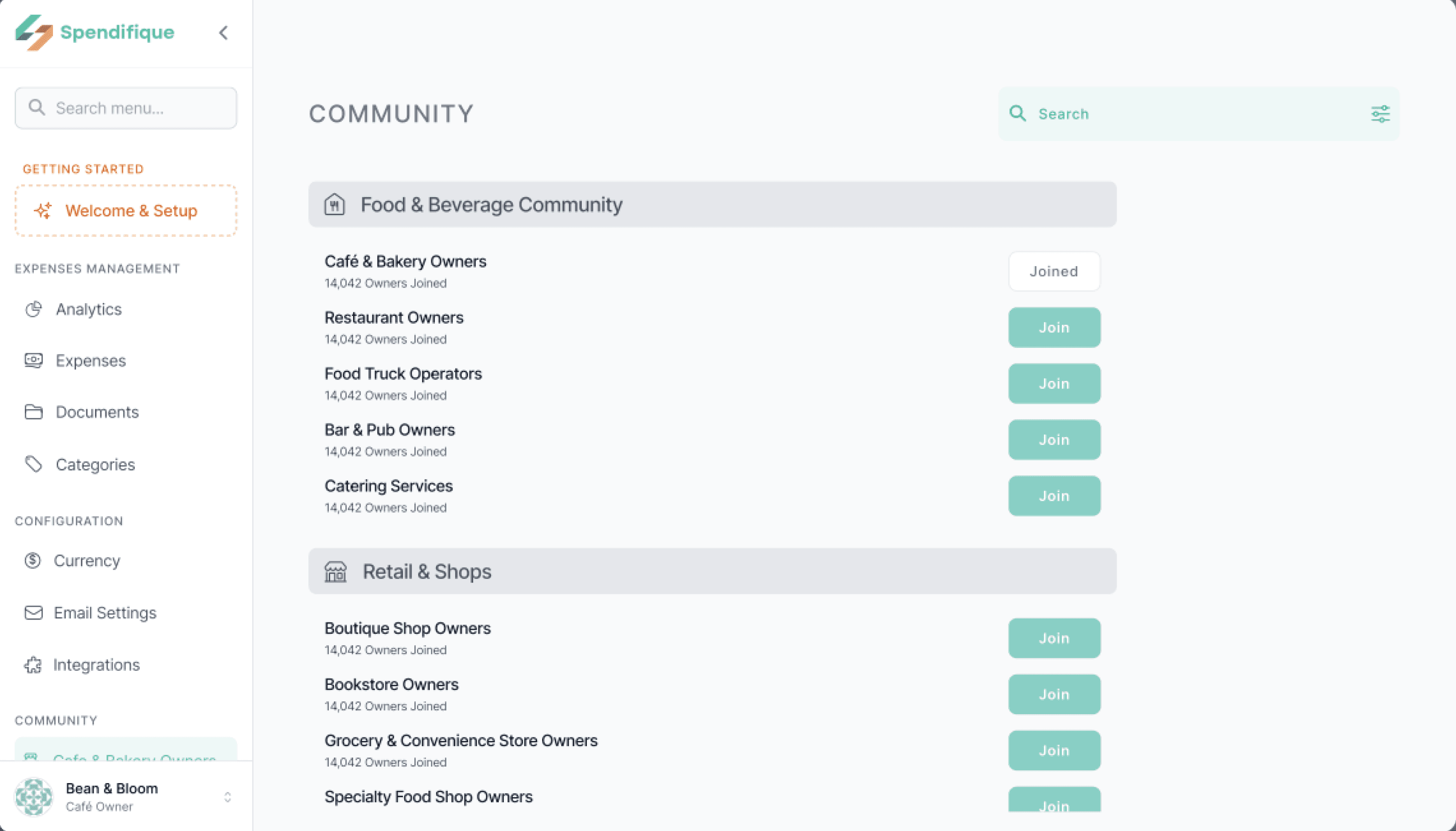

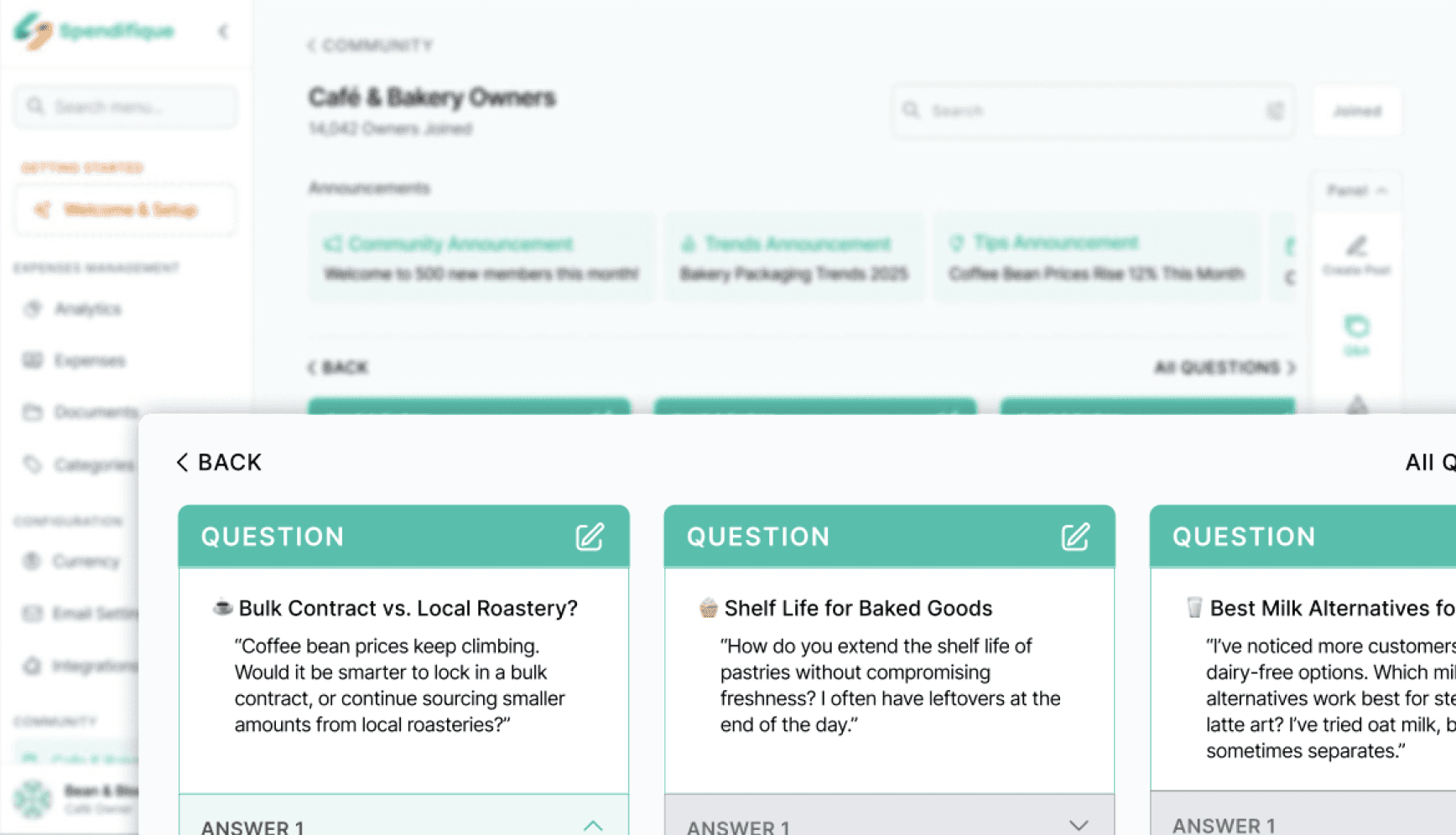

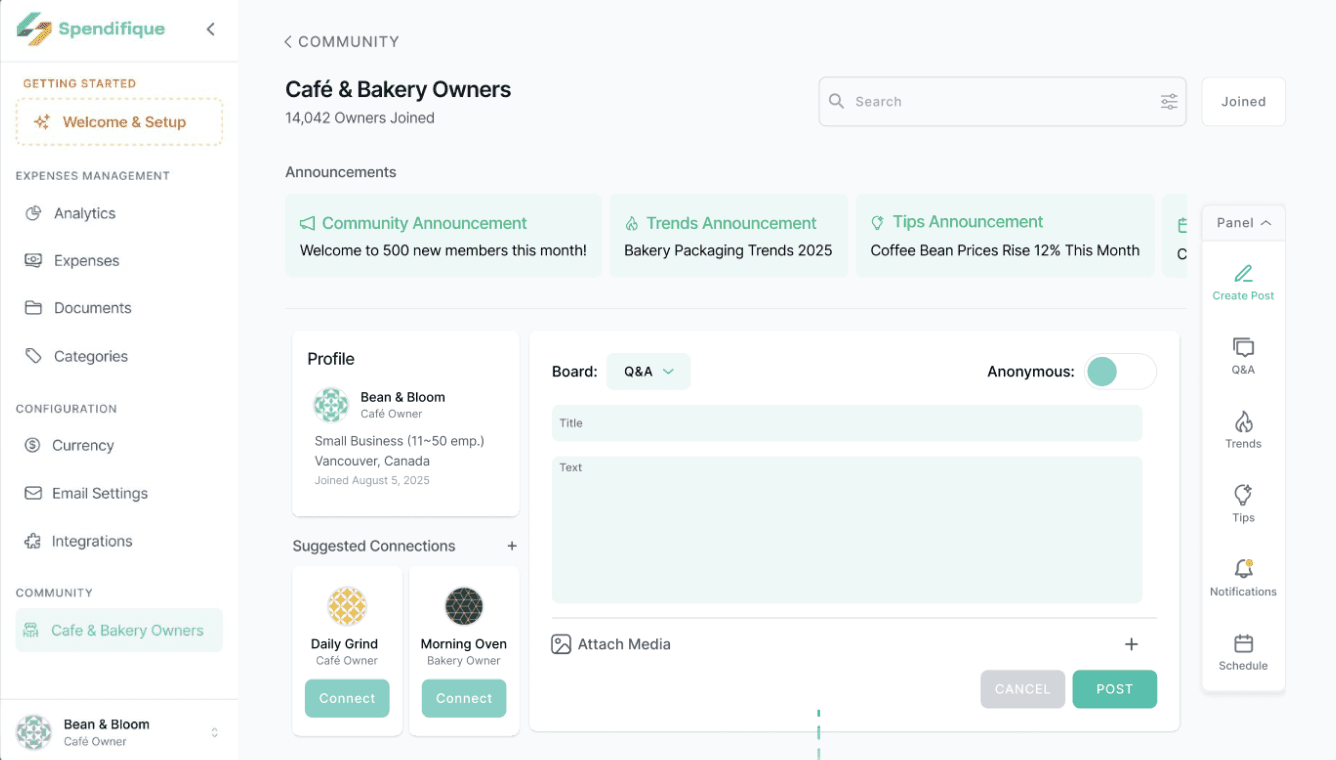

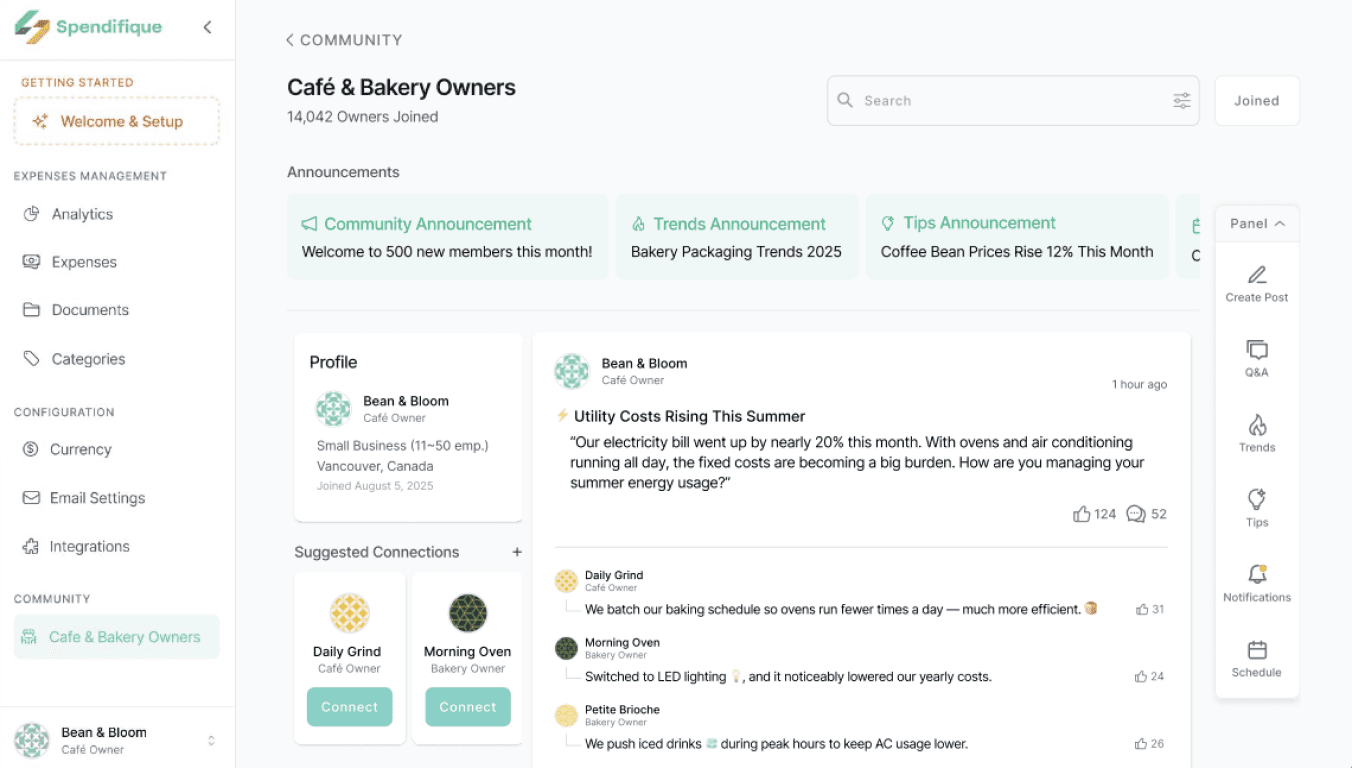

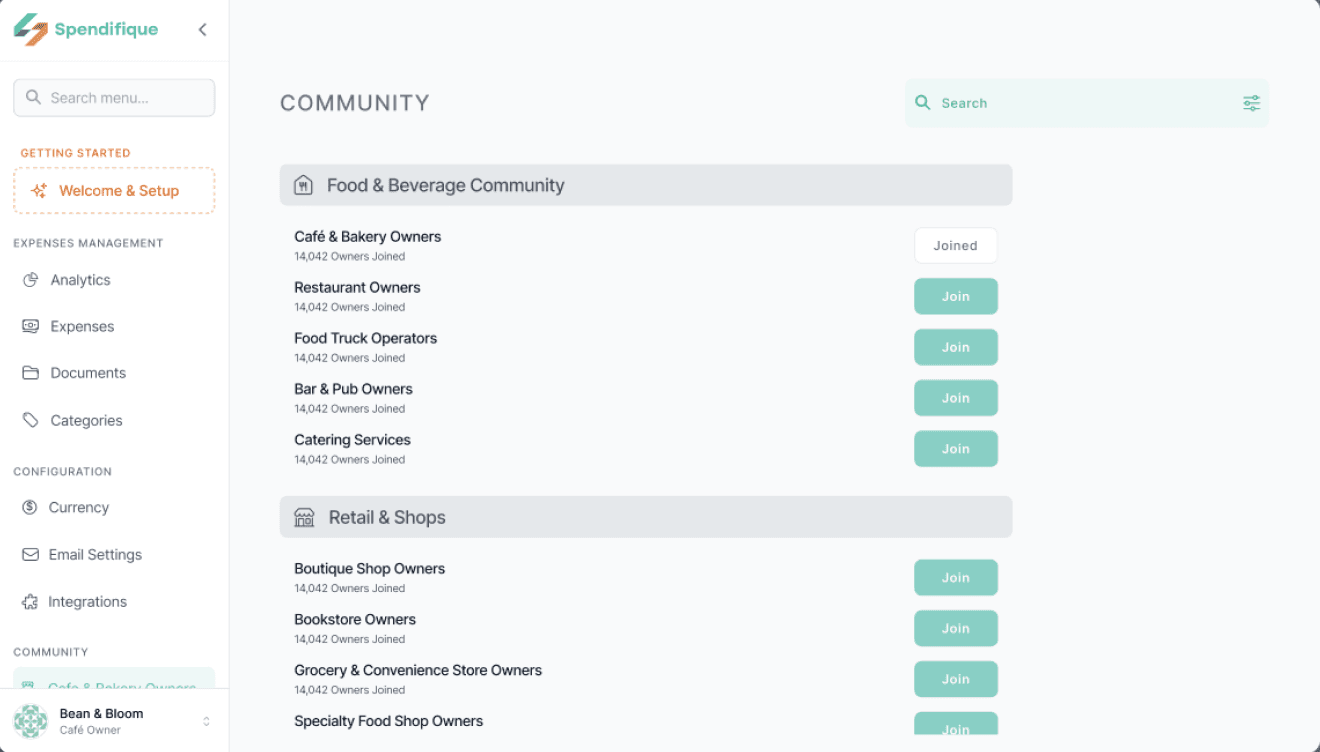

Industry Communities

Organized groups by industry (Cafes, Restaurants, Retail, etc.) with easy join options. Ensures relevant discussions and meaningful benchmarking within specific business contexts.

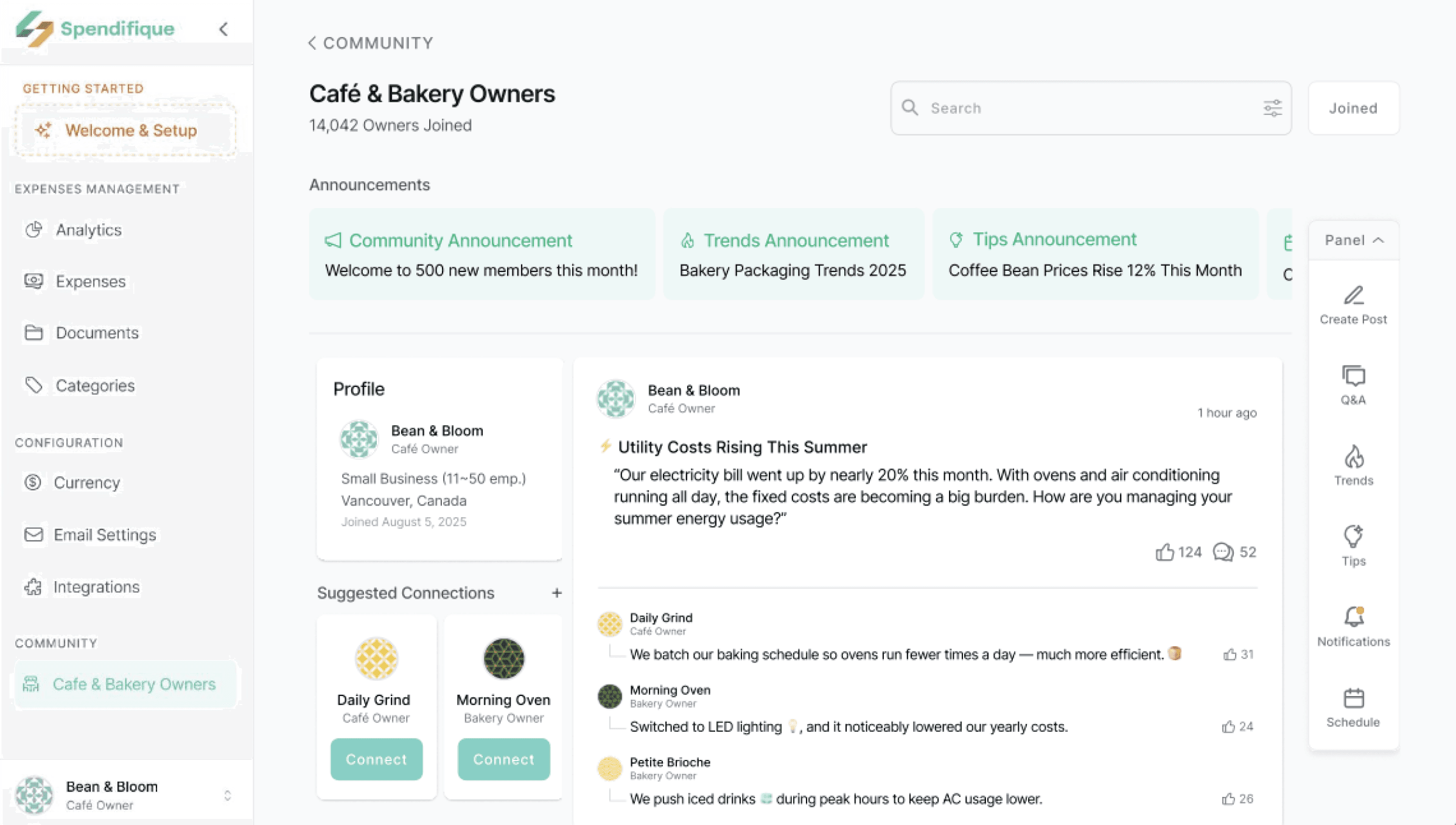

Central page with announcements, posts, and suggested connections tailored to each business type. Keeps users updated, builds a sense of belonging, and fosters contunuous participation

Designed with a simple, clean layout so users can quickly find only the information they need, keeping engagement focused and effortless.

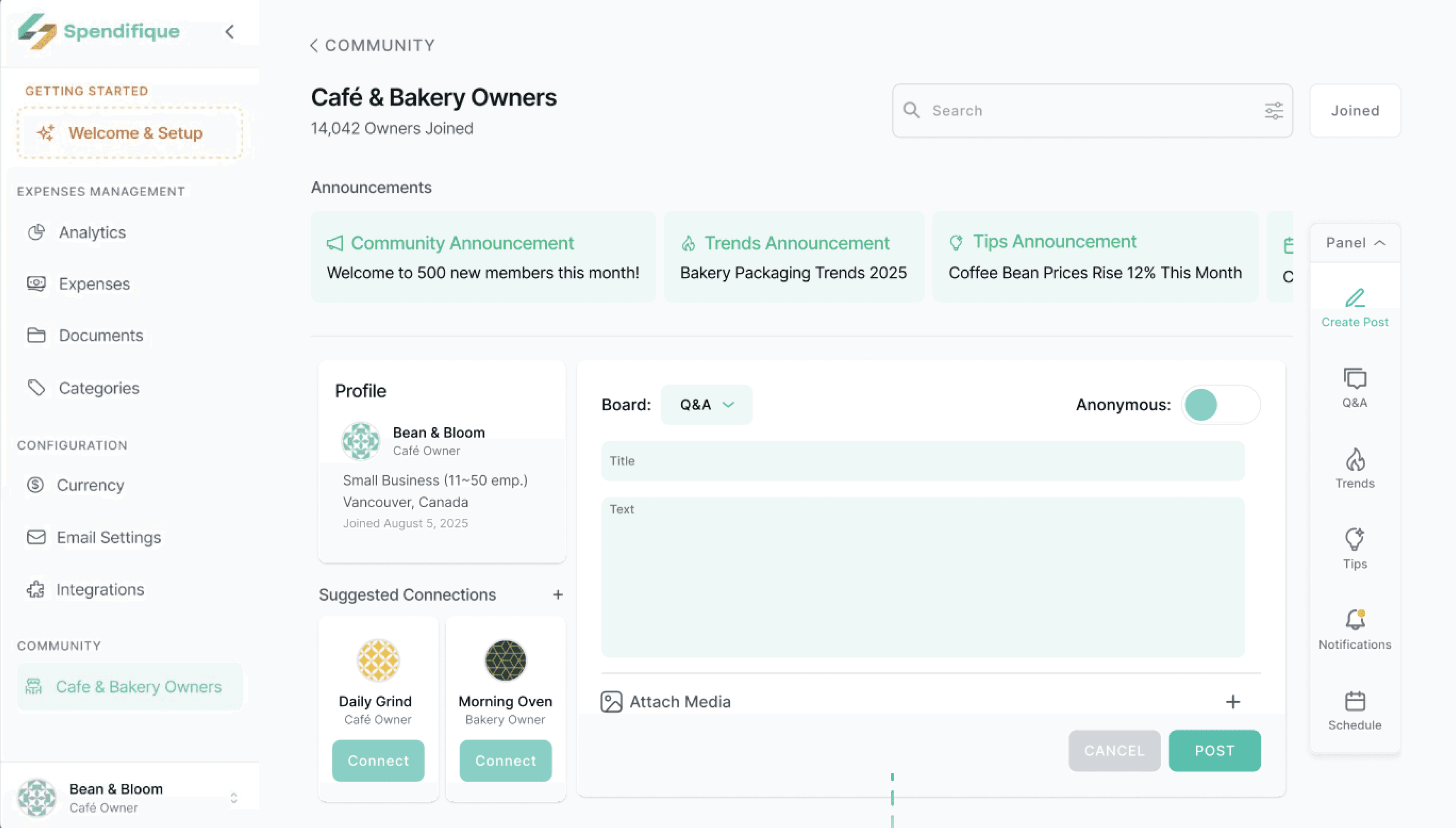

Create Post - Q&A Board

Users can post questions, share experiences, or post anonymously within their community.

Encourages peer learning and reduces isolation by connecting owners with others facing similar challenges.

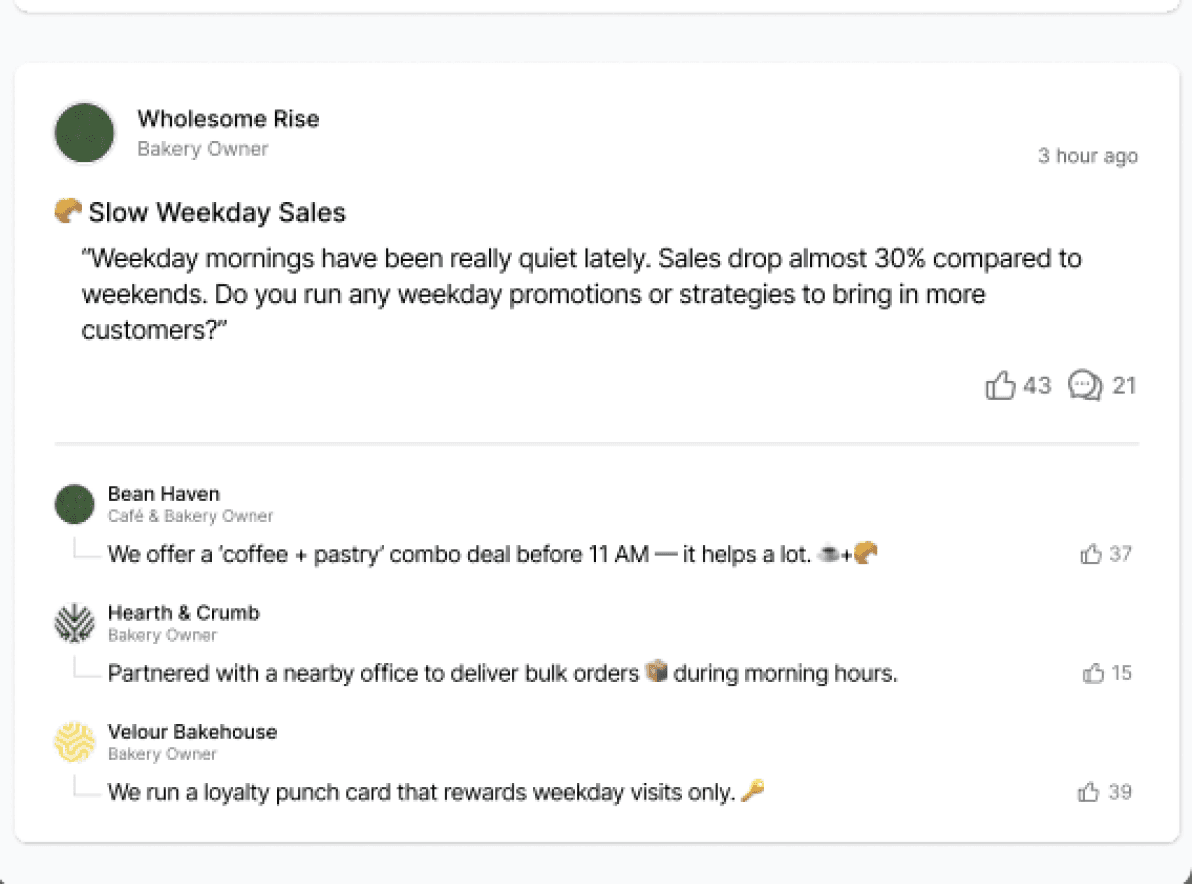

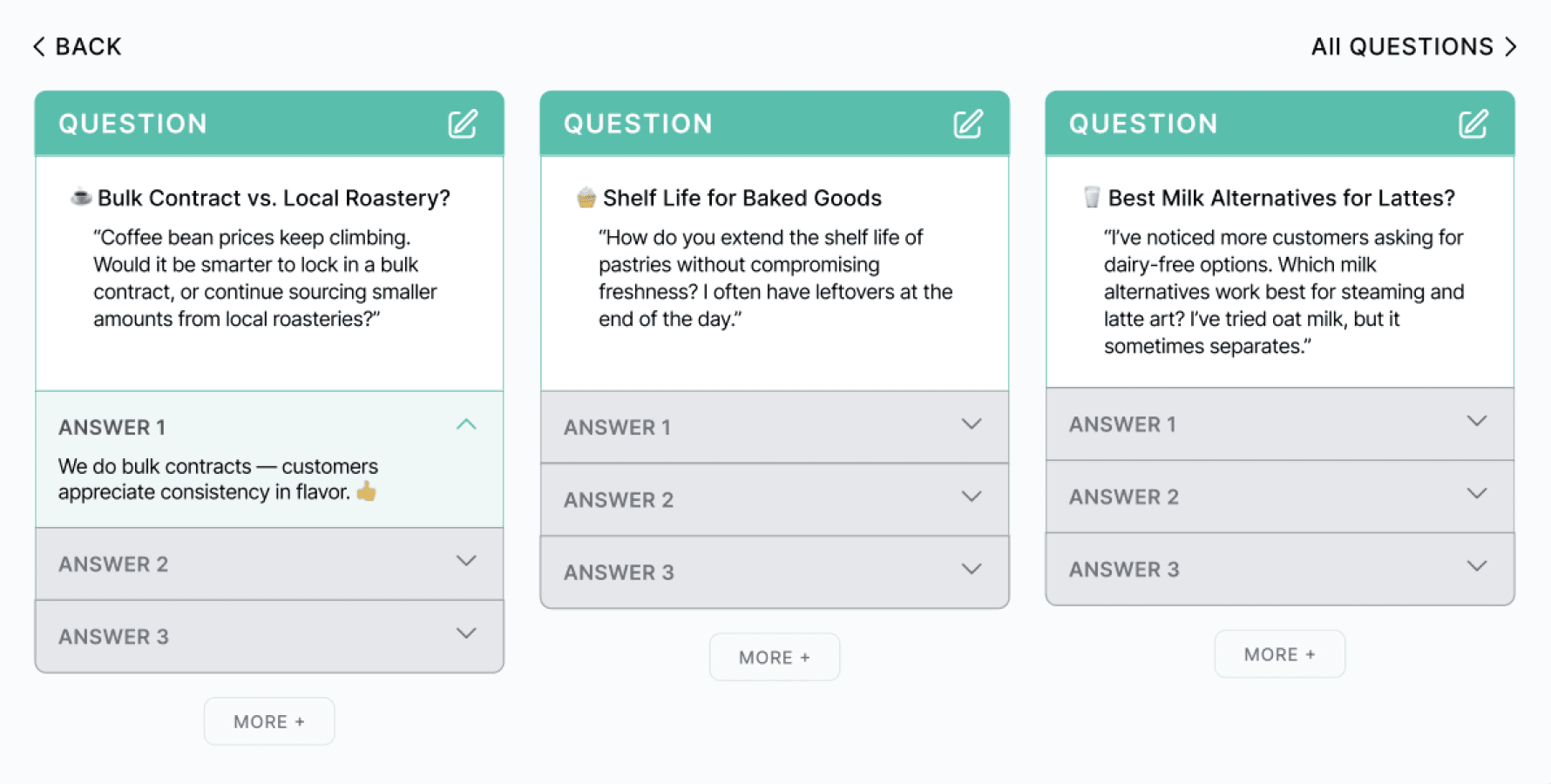

Q&A Discussion Threads

Dedicated Q&A cards with multiple answers on industry-specific topics (e.g. coffee, baking).

Turns individual struggles into collective solutions, offering practical advice from peers.

Thank you for visiting my portfolio! :)

Copyright © 2026 Tim Tang